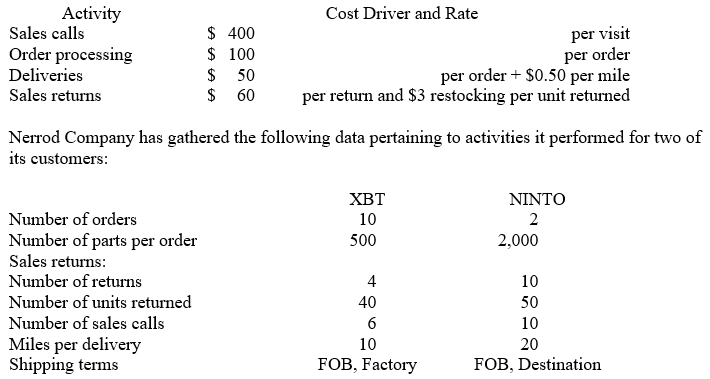

Nerrod Company sells its products at $500 per unit, net 30. The firm's gross margin ratio is 40 percent. The firm has estimated the following operating costs: What is Nerrod's total sales-sustaining cost applicable to XBT as a customer?

What is Nerrod's total sales-sustaining cost applicable to XBT as a customer?

Definitions:

Payroll Tax Expense

Payroll tax expense includes taxes imposed on employers or employees, and is based on the wages, salaries, and tips paid to the employees.

State Unemployment Taxes

Taxes imposed by state governments on employers to fund unemployment insurance benefits for laid-off workers.

Hourly Wage Rate

The amount of money paid for each hour of work performed.

Federal Income Tax Withholding

Federal income tax withholding is the process by which an employer deducts a portion of an employee's income to pay directly to the federal government as a prepaid credit towards the employee’s annual tax liability.

Q6: Which of the following is one of

Q11: The difference between wholesalers and retailers is:<br>A)

Q11: Ramirez Company uses a predetermined overhead

Q15: A data point that is outside the

Q17: Elisko Inc. is a major book distributor.

Q43: Pairing Company has the following cost drivers

Q52: Activity-based costing systems:<br>A)Accumulate overhead costs by departments.<br>B)Are

Q74: Which of the following is not a

Q99: Chen Manufacturing uses backflush costing.Chen has

Q101: Normal spoilage and abnormal spoilage should be