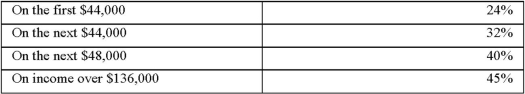

Steven James earned $150,000 this year in profits from his proprietorship,which placed him in a 45% tax bracket.The rate of tax for Canadian-controlled private corporations in his province is 15% on the first $500,000 of income.Personal tax rates (federal plus provincial)in James' province are:

(All rates are assumed for this question.)

(All rates are assumed for this question.)

Steven requires $3,000 of after-tax withdrawals per month for his personal living expenses.All remaining profits are used to pay taxes and to expand the business.Steven expects the same profits before living expenses next year.

Steven is considering incorporating his business next year.If he incorporates,he will pay himself a gross salary of $48,000.

Required:

Determine the increase in Steven's cash flow if he incorporates his company? Show all calculations.

A.Why will Steve set his new salary at $48,000?

B.Name the type of tax planning that Steve would be engaging in if he incorporated his company.

Definitions:

Cohabitating Couples

Couples who live together in a shared dwelling without being legally married.

Hypoactive Sexual Desire Disorder

A sexual dysfunction characterized by a persistent or recurrent lack of desire for sexual activity that causes personal distress.

Sexual Desire

The psychological and emotional interest in sexual activity and the anticipation of such activity.

Sexual Activity

Engaging in various forms of sexual intercourse or other sexual behaviors typically involving erotic practices.

Q2: Which of the following statements about complaints

Q28: Under the Sarbanes-Oxley Act of 2002, the

Q56: Career and sales goals should be challenging

Q58: If the volume of production is increased

Q62: Getting customers to use a higher quality

Q62: Any product, service, or organizational unit to

Q76: The income statement for a merchandising company

Q84: The time ticket shows which amount for

Q98: Certain workers are assigned the task of

Q98: List and define two primary causes of