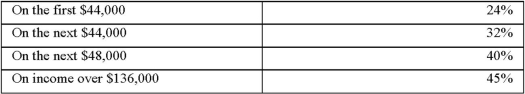

Steven James earned $150,000 this year in profits from his proprietorship,which placed him in a 45% tax bracket.The rate of tax for Canadian-controlled private corporations in his province is 15% on the first $500,000 of income.Personal tax rates (federal plus provincial)in James' province are:

(All rates are assumed for this question.)

(All rates are assumed for this question.)

Steven requires $3,000 of after-tax withdrawals per month for his personal living expenses.All remaining profits are used to pay taxes and to expand the business.Steven expects the same profits before living expenses next year.

Steven is considering incorporating his business next year.If he incorporates,he will pay himself a gross salary of $48,000.

Required:

Determine the increase in Steven's cash flow if he incorporates his company? Show all calculations.

A.Why will Steve set his new salary at $48,000?

B.Name the type of tax planning that Steve would be engaging in if he incorporated his company.

Definitions:

Operating Cycle

The duration it takes for a company to purchase inventory, sell products, and receive cash from sales, indicating the company's efficiency in managing its core operations.

Inventory Period

The average time it takes for inventory to be sold and replaced over a period, a key component of efficiency in supply chain management.

Accounts Payable Period

The average duration it takes for a company to pay off its suppliers after receiving goods or services.

Accounts Receivable Period

The mean duration that a company requires to receive payments from credit sales, reflecting the effectiveness of its policies on credit and collections.

Q3: Susan was provided with a company car

Q7: Straight commission plans offer the greatest flexibility

Q21: In which of the following types of

Q36: ABC analysis is used most successfully by

Q39: Rivera Company manufactured two products, A

Q42: Which of the following would not likely

Q50: When partnering with companies from other countries,country

Q61: Which of the following is not a

Q89: Which of the following topics is avoided

Q111: LM Company listed the following data