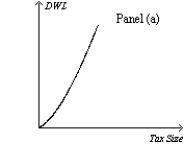

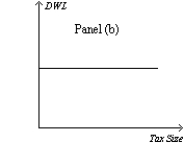

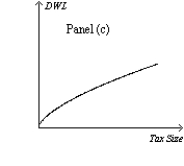

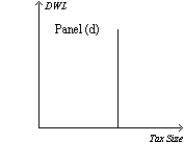

Figure 8-20

On the vertical axis of each graph,DWL is deadweight loss.

-Refer to Figure 8-20.Which graph correctly illustrates the relationship between the size of a tax and the size of the deadweight loss associated with the tax?

Definitions:

Useful Life

The estimated period of time over which an asset is expected to be usable by the entity, used for the purposes of depreciation or amortization.

Total Income Yield

refers to the percentage of income an investment generates, considering both dividend or interest payments and capital gains.

Cash Payback Period

The duration required for an investment to generate cash flows sufficient to recover the initial investment cost.

Useful Life

The estimated duration a fixed asset is expected to be productive for its intended use, impacting depreciation calculations.

Q69: The benefit to buyers of participating in

Q144: Refer to Figure 8-19. If the government

Q307: Refer to Figure 9-15. Producer surplus with

Q321: Suppose a country begins to allow international

Q373: Refer to Figure 8-25. Suppose the government

Q401: To fully understand how taxes affect economic

Q486: Refer to Figure 7-33. Suppose demand shifts

Q488: Refer to Figure 9-25. Suppose the government

Q498: Labor taxes may distort labor markets greatly

Q503: Economists disagree on whether labor taxes cause