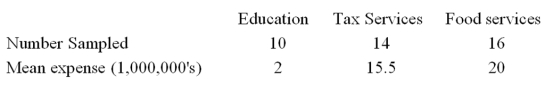

A random sample of 40 companies with assets over $10 million was selected and asked for their annual computer technology expense and industry. The ANOVA comparing the average computer technology expense among three industries rejected the null hypothesis. The Mean Square Error (MSE) was 195. The following table summarized the results:  Based on the comparison between the mean annual computer technology expense for companies in the Tax Service and Food Service industries, the 95% confidence interval shows an interval of -14.85 to 5.85 for the difference. This result indicates that

Based on the comparison between the mean annual computer technology expense for companies in the Tax Service and Food Service industries, the 95% confidence interval shows an interval of -14.85 to 5.85 for the difference. This result indicates that

Definitions:

Tax-Exempt Securities

Investments whose interest income is not subject to federal income tax, and in some cases, state and local taxes.

Residence Acquisition Debt

Mortgage debt incurred in acquiring, constructing, or substantially improving a principal residence, which is secured by the residence.

Fully Deductible

Expenses that can be subtracted in full from taxable income, reducing the total amount on which tax is calculated.

Adjusted Gross Income

involves a rephrased definition: it's the measure of income calculated from your gross income and allows for certain deductions, but before itemized or standard deductions.

Q3: A hypothesis regarding the weight of newborn

Q9: If the coefficient of correlation is -0.81,

Q27: Below is Jim Walker's income for 1995

Q31: Which of the following are true assumptions

Q37: The number of trials and the

Q39: The level of significance is the risk

Q48: The following data was collected comparing gasoline

Q63: Suppose your annual 2005 salary was $95,000

Q121: Administering the same test to a group

Q125: What value is the dividing point separating