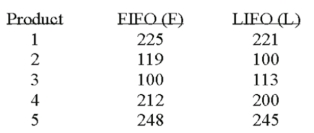

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $ thousands) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?

What is the null hypothesis?

Definitions:

D2 Receptor

A subtype of dopamine receptor crucial for many brain functions, including movement and reward, and implicated in various psychiatric and neurological disorders.

Illegal Drug

Substances whose production, sale, or possession is prohibited by law due to their potential for abuse and harm.

Intramuscular Injection

A method of administering medication deep into the muscles, allowing for fast absorption into the bloodstream.

Fentanyl Overdose

A potentially lethal condition resulting from consuming excessive amounts of the potent synthetic opioid, Fentanyl.

Q13: What is the technique used to predict

Q17: Suppose a package delivery company purchased 14

Q32: An investigation of the effectiveness of a

Q42: If two dependent samples of size 100

Q50: What is another name for the Type

Q62: What is the variable used to predict

Q69: The population variation as measured by the

Q80: What is the alternate hypothesis to test

Q81: Two samples, one of size 14 and

Q104: A company wants to study the effect