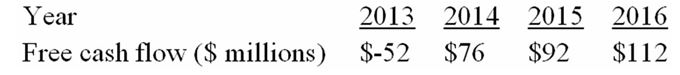

The following table presents a four-year forecast for Kenmore Air, Inc.:

-Estimate the fair market value of Kenmore Air at the end of 2012.Assume that after 2016,earnings before interest and tax will remain constant at $200 million,depreciation will equal capital expenditures in each year,and working capital will not change.Kenmore Air's weighted-average cost of capital is 11 percent and its tax rate is 40 percent.

Definitions:

Exporting

The process of selling goods or services produced in one country to markets in another country.

Marketing Growth Strategies

Techniques or plans aimed at increasing the market share, revenues, or profitability of a business through various methods, including product expansion, market penetration, and diversification.

Breakfast Menu

A selection of morning food items offered by restaurants or eateries, typically including options such as eggs, pancakes, coffees, and juices.

Lunch/Dinner Menu

A list of food items and dishes available for selection at a meal, typically outlined by restaurants for their lunch or dinner service.

Q2: Objective measures included in an evaluation and

Q11: During 2011,Lele Design earned net income of

Q13: EAC Nutrition offers a 9.5 percent coupon

Q25: A stem-and-leaf display includes the following row:

Q29: A company studied the commissions paid to

Q33: A stem-and-leaf diagram shows the actual data

Q35: A pie chart shows the relative frequency

Q70: If Gallup, Harris and other pollsters asked

Q89: A data set consists of 40 observations.

Q107: A company set up a kiosk in