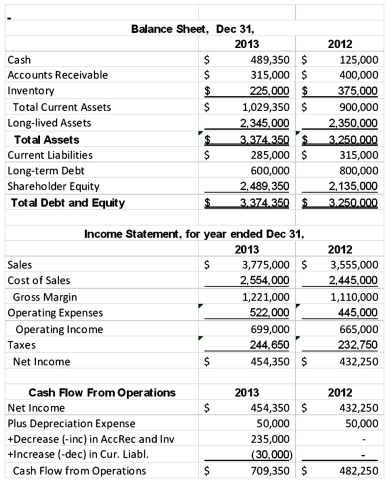

Jackson Manufacturing has the following operating results for 2013.

In addition, the company paid dividends in both 2012 and 2013 of $100,000 per year and made capital expenditures in both years of $45,000 per year. The company's stock price in 2012 was $10 and $12 in 2013. The industry average earnings multiple for the industry was 10 in 2013 and the free cash flow and sales multiples were 20 and 2, respectively. The company is publicly owned and has 1,050,000 shares of outstanding stock at the end of 2013. The industry average ratios for Jackson's industry were as follows in the most recent year.

In addition, the company paid dividends in both 2012 and 2013 of $100,000 per year and made capital expenditures in both years of $45,000 per year. The company's stock price in 2012 was $10 and $12 in 2013. The industry average earnings multiple for the industry was 10 in 2013 and the free cash flow and sales multiples were 20 and 2, respectively. The company is publicly owned and has 1,050,000 shares of outstanding stock at the end of 2013. The industry average ratios for Jackson's industry were as follows in the most recent year.

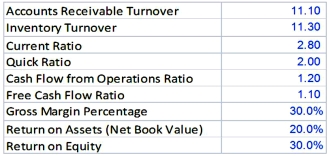

Exhibit A: Industry Ratios for the Jackson Company  Required:

Required:

1. Calculate the ratios In Exhibit A for Jackson Company for 2013, group them by category (liquidity, profitability) and develop a brief overview for the liquidity and profitability of the Jackson Company at the end of 2013.

2. Complete a Business Valuation for the Jackson Company based on 2013 financial statement information.

Definitions:

Price

The monetary figure anticipated, requisite, or paid as payment for a product.

Apples

A popular fruit known for its sweet taste, crisp texture, and variety of types, often used as a symbol in discussions comparing different goods or models in economics.

Utility Function

A numerical model illustrating how a person's choice of goods affects their happiness or utility.

Income

Income is the money that an individual or business receives in exchange for providing labor, producing goods, or investing capital.

Q10: What special problems and opportunities arise in

Q17: This question pertains to factors affecting the

Q19: A method for determining a bonus based

Q20: Well-stated objectives are:<br>A) quantifiable or measurable, and

Q52: Which of the following is a liquidity

Q78: The ideal compensation plan would make all

Q90: Which of the following factors is NOT

Q100: Determine the amount of nontraceable cost to

Q142: As noted in the text, a comprehensive

Q151: Max Ltd. produces kitchen tools, and operates