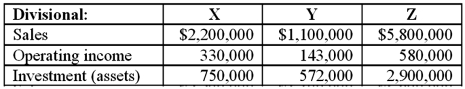

Consider the following data for three divisions of a company, X, Y, and Z:

Required:

Required:

Calculate return on investment (ROI), return on sales (ROS), and asset turnover (AT) for each division. Round your answers to two decimal places where appropriate.

Definitions:

Discount Rate

The interest rate used to discount future cash flows of a financial instrument to obtain the present value.

Purchased Goodwill

An intangible asset that arises when a company acquires another business for more than the fair value of its net identifiable assets at the acquisition date.

Market Value

The existing rate at which an asset or service is offered for buy or sell within the marketplace.

Amortize Intangible Assets

The process of systematically reducing the recorded cost of intangible assets over their useful life or legal life, whichever is shorter.

Q5: The contribution margin sales volume variance for

Q19: If both divisions were presented with an

Q28: Common bases of bonus compensation include: <img

Q49: What is the sales volume variance for

Q53: Which of the following firms uses a

Q54: Six Sigma is one approach for setting

Q59: A graph that depicts successive observations of

Q79: List and briefly discuss at least three

Q83: The estimated price that could be received

Q92: How much is the residual income (RI)