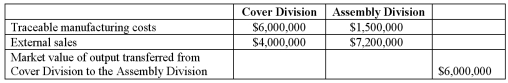

Simmons Bedding Company manufactures an array of bedding-related products, including pillows. The Cover Division of Simmons makes covers, while the Assembly Division of the company produces finished pillows. The covers can be sold separately for $10.00 a piece, while the pillows sell for $12.00 per unit. For performance-evaluation purposes, these two divisions are treated as investment centers. Financial results from the most recent accounting period are as follows:

Required:

Required:

1. What is the operating income for each of the two divisions and for the company as a whole? (Use market value as the transfer price.)

2. Do you think each of the two divisional managers is happy with this transfer-pricing method? Explain.

Definitions:

Effective Annual Yield

This refers to the real return on an investment, taking into account the effects of compounding interest over a year.

Yield To Maturity

The total return anticipated on a bond if the bond is held until its maturity date, including all payments of interest and principal.

Semi-annually

Semi-annually refers to an event or action occurring twice a year, or every six months.

Coupon Rate

The interest rate stated on a bond when it's issued which indicates the percentage of the principal to be paid annually as interest.

Q5: Can an industry be attractive to one

Q15: The set of international quality-related standards, adopted

Q16: The choice of valuation method for inventories

Q58: EVA is the acronym for:<br>A)Extra Value Assets.<br>B)Economic

Q62: A company needs financial objectives to:<br>A) spur

Q62: A unit of an organization is referred

Q71: Company objectives:<br>A) are needed only in those

Q83: A company's strategy is NOT concerned with

Q88: All of the following choices exist for

Q99: Perhaps the most reliable way for a