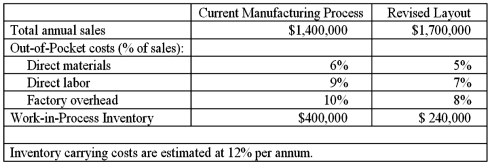

Turbo-Oven, Inc. is considering a move to cellular manufacturing. Management of the company has requested from you, as the management accountant, to supply it with information that will help inform the decision as to whether or not such a move is desirable. Your research into past performance of the company as well as extensive discussion with the manager of operations and the sales manager produced the following information.

Required:

Required:

1. In terms of the above information, provide for management of the company a rationale as to why you included each of the following items:

a. increase in total sales revenue

b. decrease in direct materials cost as a percentage of sales

c. decrease in holdings of Work-in-Process (WIP) inventory

2. Provide an estimate of each of the following financial effects associated with the proposed move to a cellular manufacturing layout:

a. change in total (out-of-pocket) manufacturing costs

b. reduction in WIP inventory holdings

c. net financial effect of the change, per year

3. In general, what types of costs would need to be incurred in order to reap the benefits outlined above in Requirement 2?

Definitions:

Dumping

The act of selling a product in a foreign market at a price below its cost of production or below the price in the home market, often considered unfair trade.

Commodity

A fundamental product utilized in trade that can be exchanged for others of its kind.

Tariffs and Quotas

Government-imposed trade restrictions; tariffs are taxes on imported goods, while quotas are limits on the quantity of goods that can be imported.

Quotas

Restrictions imposed by a government on the quantity of a good that can be imported or exported during a specific period.

Q2: Activity-based costing (ABC) and the theory of

Q10: What special problems and opportunities arise in

Q27: Jackson Manufacturing has the following operating results

Q39: The difference between the flexible-budget operating income

Q47: A favorable cost variance of significant magnitude:<br>A)Is

Q63: Accounting records from Division A, Alpha Manufacturing

Q83: A "standard cost" is a predetermined amount

Q100: Determine the amount of nontraceable cost to

Q103: A deviation from standard because of an

Q113: Explain the calculation and interpretation of a