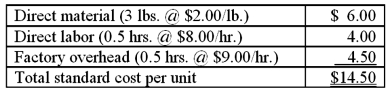

Dillard, Inc., has developed the following standard cost data based on a denominator volume of 60,000 direct labor hours (DLHs). Budgeted fixed overhead is $360,000 and budgeted variable overhead is $180,000 at this level of activity.  During the last period, the company used 48,000 DLHs to produce 128,000 units. It incurred the following manufacturing costs:

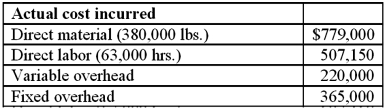

During the last period, the company used 48,000 DLHs to produce 128,000 units. It incurred the following manufacturing costs:  Required: Determine all variances for direct materials, direct labor, and factory overhead. Use a 4-variance breakdown (decomposition) of the total overhead variance for the period. Note: this problem requires knowledge from Chapter 14.

Required: Determine all variances for direct materials, direct labor, and factory overhead. Use a 4-variance breakdown (decomposition) of the total overhead variance for the period. Note: this problem requires knowledge from Chapter 14.

Definitions:

GAAP

General Accepted Accounting Principles, which are a set of accounting standards and procedures used in the US to ensure consistency in financial reporting.

U.S. Standards

Guidelines or norms established in the United States for various activities or products, often referring to quality and safety criteria.

Principles-Based

An approach focusing on underlying principles as opposed to strict compliance with detailed rules, often used in regulation and accounting.

Benchmark

A standard or point of reference against which the performance of securities, investments, or funds can be measured.

Q21: The estimated value of a real option:<br>A)Is

Q63: Which of the following items has no

Q63: Zeller Company had two products named Q

Q86: The term performance quality refers to:<br>A)The difference

Q91: The variable overhead efficiency variance in 2013

Q96: Assume that cash inflows occur evenly throughout

Q115: A firm manufactures 5,000 umbrellas per year.

Q127: Chadd Fisher was recently appointed vice president

Q132: What is the reasoning behind the misconception

Q145: Random variances are:<br>A)Often considered as uncontrollable from