Holbrook Corporation is developing departmental overhead rates based on direct labor hours for its two production departments,Molding and Assembly.The Molding Department worked 20,000 hours during the period just ended,and the Assembly Department worked 40,000 hours.The overhead costs incurred by Molding and Assembly were $151,250 and $440,750,respectively.

Two service departments,Repair and Power,directly support the two production departments.These service departments have costs of $90,000 and $250,000,respectively.The following schedule reflects the use of Repair and Power's output by the various departments:

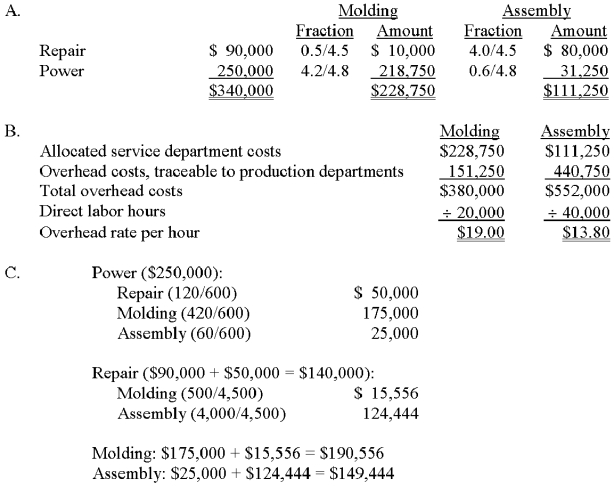

A.Allocate the company's service department costs to production departments by using the direct method.

B.Calculate the overhead application rates of the production departments.Hint: Consider both directly traceable and allocated overhead when deriving your answer.

C.Allocate the company's service department costs to production departments by using the step-down method.Begin with the Power Department,and round calculations to the nearest dollar.

Definitions:

Genogram

A graphical representation of a person's family relationships and medical history over multiple generations, used in medicine and psychology.

Family Members' Relationships

This refers to the dynamic interactions and bonds between members within a family system.

Family Genogram

A graphical representation of a person's family relationships and medical history over multiple generations, often used in counseling and social work.

Enmeshed

A term describing overly close and boundary-less relationships where individual identities become blurred.

Q15: Imputed interest can best be described as:<br>A)the

Q20: A number of antitrust laws have been

Q20: When using the breakdown method to establish

Q47: For the period just ended,United Corporation's Delta

Q48: Regarding the drawing of territorial boundary lines:<br>A)This

Q61: The revenue curve shows the relationship between

Q71: The systematic follow-up on a capital project

Q77: If a firm has no excess capacity,which

Q78: Consider the following statements about taxes and

Q104: Which of the following statements is true?<br>A)Sales