Douglas Company,a new firm,manufactures two products,J and K,in a common process.The joint costs amount to $80,000 per batch of finished goods.Each batch results in 20,000 liters of output,of which 80% are J and 20% are K.

The two products are processed beyond the split-off point,with Douglas incurring the following separable costs: J,$2 per liter;K,$5 per liter.After the additional processing,the selling price of J is $12 per liter,and the selling price of K is $15 per liter.

Required:

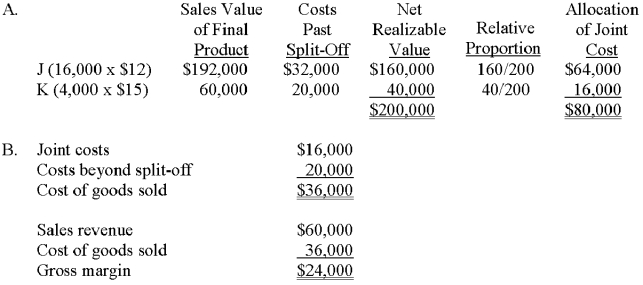

A.Determine the proper allocation of joint costs if the company uses the net-realizable-value method.

B.Assume that Douglas sold all of its production of K during the current accounting period.Compute K's sales revenue,cost of goods sold,and gross margin.

C.Is the firm's cost-of-goods-sold figure influenced by the choice of a joint-cost allocation method? Briefly explain.

C.Yes.Cost of goods sold is based on both separable costs and joint cost.The choice of an allocation method will influence the amount of joint cost charged to the product.

Definitions:

Predetermined Overhead Rate

The rate used to allocate manufacturing overhead to individual products or job orders, calculated before the period begins based on estimated costs and activity levels.

Machine-Hours

A measure of production time, indicating the total hours that machines have been operating during a given period.

Fixed Manufacturing Overhead

The total of all costs that remain constant regardless of the level of production within a certain range.

Machining Department

A division within a manufacturing facility where machining processes such as cutting, drilling, or shaping are performed.

Q3: The controlling factor in all budgeting and

Q17: Consider the following statements about service department

Q20: When using the breakdown method to establish

Q35: The capital turnover is:<br>A)3.33.<br>B)5.00.<br>C)16.67.<br>D)20.00.<br>E)30.00.<br>

Q40: It is recommended that sales managers review

Q52: When sophisticated computer modeling is used to

Q59: If a rep works eight hours per

Q62: The curve that shows the relationship between

Q77: For a company that uses responsibility accounting,which

Q84: An unlimited payment plan for controlling sales