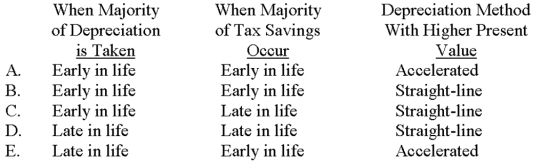

Preston Company is considering the use of accelerated depreciation rather than straight-line depreciation for a new asset acquisition.Which of the following choices correctly shows when the majority of depreciation would be taken (early or late in the asset's life) ,when most of the tax savings occur (early or late in the asset's life) ,and which depreciation method would have the higher present value?

Definitions:

U.S. Trustee

A government official who performs administrative tasks that a bankruptcy judge would otherwise have to perform.

Petition

A formal written request, often signed by several individuals, appealing to authority with respect to a particular cause.

Cram-down Provision

A legal mechanism in bankruptcy proceedings allowing a court to approve a reorganization plan over the objections of some creditors.

Chapter 11

A provision of the United States Bankruptcy Code that allows businesses to reorganize and try to stay afloat while temporarily holding creditors at bay.

Q7: One drawback to the expense control plan

Q9: Which of the following terms describes a

Q13: Hunters,Inc.uses a standard cost system when accounting

Q36: Torrey Pines is studying whether to outsource

Q47: The Metropolitan Clinic has two service departments

Q54: A sales quota based on activities performed

Q55: Eliza,Inc.was having significant quality problems in its

Q56: The payback period is best defined as:<br>A)initial

Q62: In team sales,the management position most likely

Q82: Common costs are charged to a company's