Lasley Corporation is considering the acquisition of a new machine that is expected to produce annual savings in cash operating costs of $30,000 before income taxes.The machine costs $100,000,has a useful life of five years,and no salvage value.Lasley uses straight-line depreciation on all assets,is subject to a 30% income tax rate,and has an after-tax hurdle rate of 8%.

Required:

A.Average income: ($30,000 - $20,000)* 0.70 = $7,000

Accounting rate of return: $7,000 / $100,000 = 7%

A.Compute the machine's accounting rate of return on the initial investment.

B.

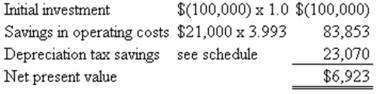

Depreciation tax savings:

Year 1: 10,000 x .3 = 3,000 x .926 = 2,778

Year 2: 20,000 x .3 = 6,000 x .857 = 5,142

Year 3: 20,000 x .3 = 6,000 x .794 = 4,764

Year 4: 20,000 x .3 = 6,000 x .735 = 4,410

Year 5: 20,000 x .3 = 6,000 x .681 = 4,086

Year 6: 10,000 x .3 = 3,000 x .630 = 1,890

TOTAL $23,070

NPV = $106,923

B.Compute the machine's net present value.

Definitions:

Medical Model

An approach to understanding and treating mental disorders by focusing on biological and physiological explanations and treatments.

Anatomical Deviation

A variation from the normal anatomical structure or position, which may be congenital or acquired.

Unconscious Causes

Factors that influence behavior and decisions without the individual's awareness.

Alphabetical Classification

A method of organizing items or information according to the sequence of letters in the alphabet.

Q12: Consider the following situation:<br>The marketing manager of

Q14: Salvio Enterprises has identified the following as

Q21: The following costs are relevant to the

Q24: An advantage of using the executive-opinion method

Q31: When allocating service department costs,companies should use:<br>A)actual

Q38: Budgeting in the sales department is most

Q64: A favorable labor efficiency variance is created

Q67: Value added components are:<br>A)Sales promotion giveaways.<br>B)Things such

Q74: The point in a joint production process

Q78: Belcher Company,which desires to enter the market