The following information relates to DFW Corporation:

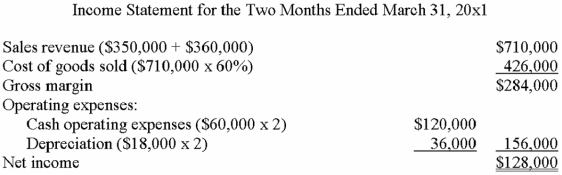

· All sales are on account and are budgeted as follows: February,$350,000;March,$360,000;and April,$400,000.DFW collects 70% of its sales in the month of sale and 30% in the following month.

· Cost of goods sold averages 60% of sales.Purchases total 65% of the following month's sales and are paid in the month following acquisition.

· Cash operating expenses total $60,000 per month and are paid when incurred.Monthly depreciation amounts to $18,000.

· Selected amounts taken from the January 31 balance sheet were: accounts receivable,$115,000;plant and equipment (net),$107,000;and retained earnings,$85,000.

Required: (NOTE: Ignore income taxes in answering these questions).

A.

A.Prepare a budgeted income statement that summarizes activity for the two months ended March 31,20x1.

B.Accounts receivable: $115,000 - $115,000 + $350,000 - ($350,000 * 70%)+ $360,000 - ($350,000 * 30%)- ($360,000 *70%)= $108,000

Plant and equipment (net): $107,000 - $18,000 - $18,000 = $71,000

Retained earnings: $85,000 + $128,000 = $213,000

B.Compute the amounts that would appear on the March 31 balance sheet for accounts receivable,plant and equipment (net),and retained earnings.

Definitions:

Diagnose Obesity

The process of determining whether an individual's body weight is in the range considered obese based on criteria such as Body Mass Index (BMI).

First Tooth

The emergence of the initial tooth in a baby, typically occurring between six months to one year of age.

Middle Childhood

A developmental phase typically ranging from about 6 to 12 years of age, characterized by cognitive, social, and physical growth.

Brain Development

The process of growth and change in the brain's structure, function, and pathways that occur over the course of a lifetime, particularly significant during childhood.

Q3: Highway Company reported the following costs for

Q10: Activity-based costing systems:<br>A)use a single,volume-based cost driver.<br>B)assign

Q18: Sammons Corporation had a favorable direct-labor efficiency

Q18: A variable cost that has a definitive

Q20: Taylor's direct-material quantity variance was:<br>A)$7,800F.<br>B)$16,800F.<br>C)$7,800U.<br>D)$16,800U.<br>E)None of thesE.<br>

Q20: Many firms are moving toward flexible manufacturing

Q50: At a volume of 20,000 units,Dries reported

Q54: The following data relate to Lebeaux Corporation

Q55: Which of the following statements is (are)true

Q74: Cornwall Corporation manufactures faucets.Several weeks ago,the company