The following information relates to DFW Corporation:

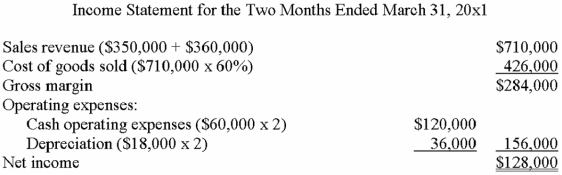

· All sales are on account and are budgeted as follows: February,$350,000;March,$360,000;and April,$400,000.DFW collects 70% of its sales in the month of sale and 30% in the following month.

· Cost of goods sold averages 60% of sales.Purchases total 65% of the following month's sales and are paid in the month following acquisition.

· Cash operating expenses total $60,000 per month and are paid when incurred.Monthly depreciation amounts to $18,000.

· Selected amounts taken from the January 31 balance sheet were: accounts receivable,$115,000;plant and equipment (net),$107,000;and retained earnings,$85,000.

Required: (NOTE: Ignore income taxes in answering these questions).

A.

A.Prepare a budgeted income statement that summarizes activity for the two months ended March 31,20x1.

B.Accounts receivable: $115,000 - $115,000 + $350,000 - ($350,000 * 70%)+ $360,000 - ($350,000 * 30%)- ($360,000 *70%)= $108,000

Plant and equipment (net): $107,000 - $18,000 - $18,000 = $71,000

Retained earnings: $85,000 + $128,000 = $213,000

B.Compute the amounts that would appear on the March 31 balance sheet for accounts receivable,plant and equipment (net),and retained earnings.

Definitions:

Tree Ferns

Ancient group of plants with large leaves and a trunk resembling a tree, thriving mostly in tropical and subtropical regions.

Cycads

Slow-growing, palm-like plants from the order Cycadales, known for their large compound leaves and production of cones.

Seedless Vascular Plants

Plants that have vascular tissue for transporting water and nutrients but reproduce through spores rather than seeds.

Sporophytes

The diploid generation in the life cycle of plants that produces spores through meiosis, alternates with the haploid gametophyte stage.

Q9: Telfair & Company had 3,000 units in

Q33: Indiana's per-unit inventoriable cost under absorption costing

Q42: The Purchasing Department would normally begin an

Q42: Forest Company,which uses a weighted-average process-costing system,had

Q43: The fixed-overhead budget and volume variances are:

Q46: Bowman,Inc. ,has only variable costs and fixed

Q54: Hatchcox Company is studying the impact of

Q70: A cost object is:<br>A)a collection of costs

Q91: The difference between the revenue or cost

Q100: When a company switches from a traditional