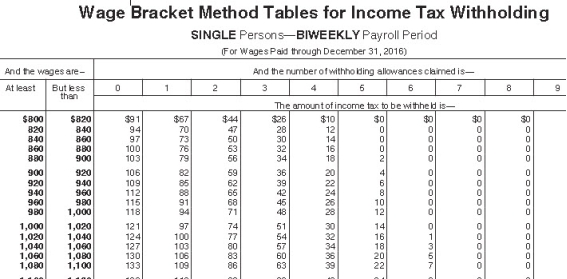

Tierney is a full-time nonexempt salaried employee who earns $990 per biweekly pay period.She is single with 1 withholding allowance and both lives and works in Maryland.Assuming that she had no overtime,what is the total of her federal and state taxes for a pay period? (Use the wage-bracket tables.Maryland state income rate is 2.0%.Round final answers to 2 decimal places. )

Definitions:

Q9: Of the 40 worst disasters between 1970

Q11: The factors that determine an employee's federal

Q16: In the _,evidence abounded,mechanisms seemed plausible,and the

Q25: Danny is a full-time exempt employee in

Q26: According to the Consumer Credit Protection Act,what

Q27: Under a 401(k)plan,you can elect to have

Q30: Which document explains,adds,or deletes provisions in your

Q59: The total of a firm's annual wages

Q81: A credit-shelter trust is perhaps the most

Q133: Keogh plans can be both defined-contribution and