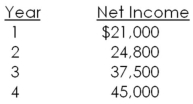

An investment has an initial cost of $420,000 and will generate the net income amounts shown below.This investment will be depreciated straight-line to zero over the four-year life of the project.Should this project be accepted based on the average accounting rate of return if the required rate is 16 percent? Why or why not?

Definitions:

Invested Capital

Funds provided by investors or lenders used by a company to acquire or upgrade physical assets like buildings and machinery.

Return On Investment

A performance measure used to evaluate the efficiency or profitability of an investment, calculated as the net profit divided by the cost of the investment.

Residual Income

The amount of income that exceeds the minimum rate of return expected on investments or capital.

Residual Income

The income that remains after all costs of capital used to generate revenues have been subtracted.

Q5: Twelve years ago,you deposited $3,400 into an

Q15: Arts and Crafts Warehouse wants to issue

Q20: Your grandparents just gave you a gift

Q38: Industrial Services is analyzing a proposed investment

Q51: Steve is considering investing $3,600 a year

Q53: Explain how the selection of a method

Q55: The NYSE:<br>A)presently conducts all of its trading

Q57: Swan Lake Marina is expected to pay

Q90: Scenario analysis asks questions such as:<br>A)How will

Q106: Phil's Dinor purchased some new equipment two