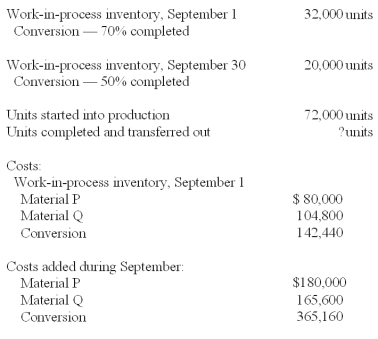

Talamoto Co.manufactures a single product that goes through two processes - mixing and cooking.The following data pertains to the Mixing Department for September.

Material P is added at the beginning of work in the Mixing Department.Material Q is also added in the Mixing Department,but not until units of product are forty percent completed with regard to conversion.Conversion costs are incurred uniformly during the process.

Total equivalent units for Material P under the weighted-average method are calculated to be:

Definitions:

Fixed Manufacturing Overhead

Costs in the production process that remain constant regardless of the production volume, such as rent or salaries of permanent staff.

Inventories Deferred

Inventories or stock that are postponed or delayed from being recognized in the financial statements.

Variable Costing

An accounting method that includes only variable production costs (direct materials, direct labor, and variable manufacturing overhead) in the cost of goods sold, excluding fixed overhead.

Variable Costing

Variable costing is a costing method that includes only variable production costs (direct materials, direct labor, and variable manufacturing overhead) in product costs.

Q10: In order to remain competitive in the

Q15: A time ticket:<br>A)Shows the time an employee

Q16: Budgets can serve as the standard against

Q21: All the following are characteristic of relevant

Q26: In SWOT analysis,opportunities and threats are identified

Q35: Depending on the nature of rework done

Q42: James Automotive Group is a maker of

Q60: Pearson Electric Company uses the high-low method

Q82: General Manufacturing expects to have 40,000 pounds

Q129: Costs at the unit-level of activity should