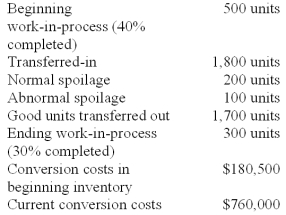

James Automotive Group is a maker of engines for high performance cars and uses a process costing system.The following information pertains to the final department of James' outstanding engine called "Superior-1".

James calculates separate costs of spoilage by computing both normal and abnormal spoiled units.Normal spoilage costs are reallocated to good units and abnormal spoilage costs are charged as a loss.The units of "Superior-1" that are spoiled are the result of defects not discovered before inspection of finished units.Using the weighted-average method,what are the total conversion costs transferred to finished goods?

Definitions:

Allocation-Base Usage

The process of distributing costs based on a predetermined criterion or base, such as machine hours or labor costs.

Activity-Based Costing

Activity-based costing is a method in accounting that assigns costs to products and services based on the resources they consume and the activities undertaken to produce them.

Period Costs

Expenses that are incurred by a business during a specific time period but are not directly tied to the production of goods and are reported immediately in the company's income statement.

Factory Overhead Allocation

The process of distributing indirect manufacturing costs, such as utilities and rent, across various products based on a predetermined rate or method.

Q4: The sum of units transferred out and

Q13: Williams Pharmaceutical Company is a maker of

Q22: Which of the following perspectives of a

Q24: OutlyTech Corp.expected to sell 24,000 telephone switches.Fixed

Q31: A strategy can be best defined as:<br>A)An

Q32: Which of the following most accurately describes

Q52: When using cost-volume-profit (CVP)analysis,the following information helps

Q59: Marin Products produces three products - DBB-1,DBB-2,and

Q65: Nantucket Company has the following cost-volume-profit (CVP)relationships:

Q78: Williams Company is an East Coast producer