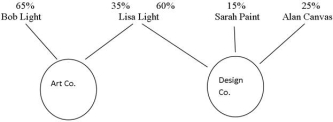

The following diagram depicts the ownership structure of two CCPCs.Bob Light is Lisa Light's son.Sarah Paint and Alan Canvas are not related to Bob and Lisa in any manner,whatsoever,or to one another.All of the shares held are common shares.

In 20xx,Art Co.earned $700,000 of active business income and Design Co.earned $500,000 of active business income.Art Co.'s taxable income was $750,000 and Design Co.'s taxable income was $500,000.Art Co.reported $100,000 of adjusted aggregate investment income in the previous year.Design Co.did not report any investment income.The two companies have decided that Design Co.will not use any of the small business deduction in 20xx.The combined taxable capital of the two corporations is less than $10 million.(20xx is after 2018.)

Required:

A)Determine if the two companies are associated,referring to the applicable section of the Income Tax Act.

B)Calculate the amount available for the small business deduction to Art Co.in 20xx.

Definitions:

Razor Blades

Thin, sharp blades used primarily for shaving or cutting.

Asexual

Lacking any interest in or desire for sex.

Sexual Desire

A person's appetite or interest in engaging in sexual activities or experiencing sexual pleasure.

Interest

The feeling of wanting to know or learn about something or someone.

Q1: There are several benefits to incorporating a

Q1: Which of the following accurately describes one

Q3: Andy worked for High Speed Bikes Inc.from

Q3: With respect to GST/HST,supplies fall under different

Q7: An individual has the option to receive

Q9: Which of the following is not considered

Q12: _ means making the right decisions and

Q15: Overseeing timely delivery of your daily newspaper

Q76: When a manager encourages employees to improve

Q204: If $1 equals 2 euros,then 1 euro