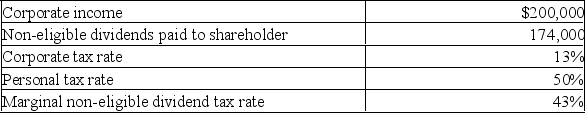

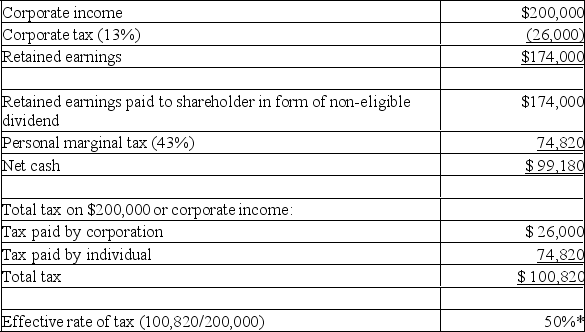

The Canadian tax system practices integration between corporations and individuals.Using the data in Table 1 and assumed rates,illustrate and explain the concept of integration.

Table 1

Definitions:

Lot Sizes

Lot sizes refer to the quantity of items grouped together for manufacturing or purchasing purposes, affecting production planning and inventory management.

Economic Order Quantity

A formula used to determine the most cost-effective quantity to order stock, minimizing both ordering and holding costs.

Carrying Costs

Expenses associated with holding inventory, such as storage, insurance, and opportunity costs.

Safety Stock

A quantity of inventory kept on hand as a precaution against fluctuations in demand or supply, ensuring the mitigation of stockout risks.

Q1: Joe Genius of ABC Corporation is considering

Q1: TriStar Industries was recently denied the deduction

Q5: Bean Co.is a Canadian-controlled private corporation with

Q6: Stan is the sole shareholder of Hardware

Q7: A public corporation earns $500,000 in pre-tax

Q8: Sarah borrowed $25,000 from her employer at

Q18: A trend in developing countries is that<br>A)

Q21: The general environment of organizations have all

Q42: The GATT's most-favored nation clause means that

Q60: Dumping is the practice of<br>A) selling a