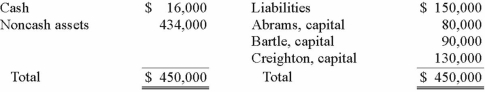

The Abrams, Bartle, and Creighton partnership began the process of liquidation with the following balance sheet:  Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000. The noncash assets were sold for $134,000. Which partner(s) would have had to contribute assets to the partnership to cover a deficit in his or her capital account?

Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000. The noncash assets were sold for $134,000. Which partner(s) would have had to contribute assets to the partnership to cover a deficit in his or her capital account?

Definitions:

Interest-Bearing Note

A debt instrument that pays interest at a predetermined rate to the holder, typically issued in exchange for a loan or credit extended to the borrower.

Maturity Value

The amount that is due at the maturity or due date of a note.

Interest Rate

The percentage of a sum of money charged for its use, often expressed as an annual percentage rate.

Allowance Method

An accounting technique that estimates and sets aside a portion of accounts receivable which may not be collectible.

Q12: The 19<sup>th</sup> century embryologist K.E.von Baer examined

Q18: Hardin, Sutton, and Williams have operated a

Q18: On January 1, 2013, Fandu Corp.

Q29: In the case of tall and dwarf

Q42: If eukaryotes are more complex than prokaryotes,then

Q47: Describe the structure of cilia and flagella

Q78: An alternative environment to the "hot dilute

Q83: Car Corp. (a U.S.-based company) sold

Q85: P, L, and O are partners with

Q90: A foreign subsidiary of a U.S. corporation