Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

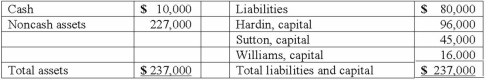

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

Definitions:

Net Present Value

Net present value (NPV) is the calculation used to find today’s value of a future stream of payments and earnings, accounting for the time value of money.

Cost of Capital

The return rate that a company must achieve in order to compensate its investors for the risk of the investment, including the cost of equity and debt.

Industrial Furnace

A device used in manufacturing to provide high temperatures for processes such as melting metals or chemical reactions.

Real Option

The right, but not the obligation, to undertake certain business initiatives, such as deferring, abandoning, expanding, staging, or contracting a project.

Q18: Hardin, Sutton, and Williams have operated a

Q25: Which is NOT a characteristic of mitochondria?<br>A)

Q38: The enzyme-substrate complex is<br>A) not strong and

Q51: Religious groups formerly proclaiming their views under

Q51: Which of the following is a governmental

Q57: Which of the following is not a

Q62: Under the temporal method, retained earnings would

Q81: What is the dissolution of a partnership?

Q83: Under what circumstances would the remeasurement of

Q91: Dilty Corp. owned a subsidiary in France.