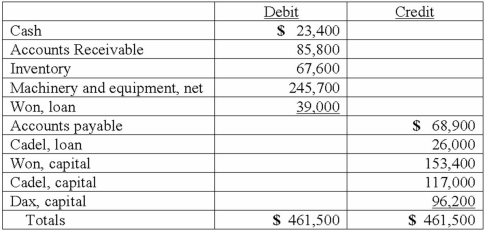

On January 1, 2013, the partners of Won, Cadel, and Dax (who shared profits and losses in the ratio of 5:3:2, respectively) decided to liquidate their partnership. The trial balance at this date was as follows:

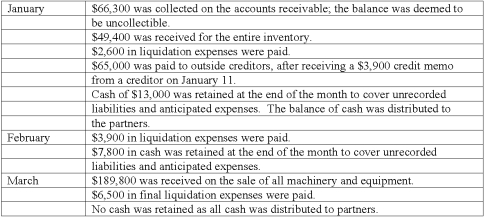

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:  Prepare a schedule to calculate the safe payments to be made to the partners at the end of January.

Prepare a schedule to calculate the safe payments to be made to the partners at the end of January.

Definitions:

Gross Income

The total income earned by an individual or a business before any deductions or taxes are taken.

Royalties

A payment made to a patent owner, author, or composer for each sale or use of their work.

Tax Proration

The division of property taxes, insurance premiums, or other charges in proportion to time or use.

Annual Tax Bill

The total amount of taxes levied annually by various governmental entities, including federal, state, and local taxes.

Q4: An important technique that allows biologists to

Q5: The earliest source of reduced compounds for

Q19: Norr and Caylor established a partnership on

Q28: Reed, Sharp, and Tucker were partners with

Q35: Identify the various cell structures that have

Q36: Patti Company owns 80% of the common

Q50: A local partnership has assets of cash

Q61: Boerkian Co. started 2013 with two

Q66: Who first performed an experiment that proved

Q97: Ryan Company owns 80% of Chase