Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

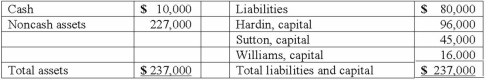

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

Definitions:

Obsessive-compulsive Disorder

A chronic mental health condition where people experience unwanted thoughts (obsessions) and repetitive behaviors (compulsions).

Phobia

An intense, irrational fear of specific objects, situations, or activities that can significantly interfere with daily functioning.

Modeling

A method used in psychology to learn new behaviors by observing and imitating others.

Systematic Desensitization

A behavioral therapy technique that gradually exposes the individual to the object of their fear in a controlled manner, alongside relaxation exercises, to reduce phobic responses.

Q5: The earliest source of reduced compounds for

Q15: The Amos, Billings, and Cleaver partnership had

Q25: For government-wide financial statements, what account is

Q32: All of the following data may be

Q42: Which of the following is a coenzyme?<br>A)

Q43: Much of science is based on an

Q56: Under the current rate method, inventory at

Q65: Meisner Co. ordered parts costing §100,000 for

Q72: White, Sands, and Luke has the following

Q83: Cleary, Wasser, and Nolan formed a partnership