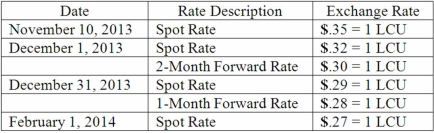

On November 10, 2013, King Co. sold inventory to a customer in a foreign country. King agreed to accept 96,000 local currency units (LCU) in full payment for this inventory. Payment was to be made on February 1, 2014. On December 1, 2013, King entered into a forward exchange contract wherein 96,000 LCU would be delivered to a currency broker in two months. The two month forward exchange rate on that date was 1 LCU = $.30. Any contract discount or premium is amortized using the straight-line method. The spot rates and forward rates on various dates were as follows:  The company's borrowing rate is 12%. The present value factor for one month is .9901.

The company's borrowing rate is 12%. The present value factor for one month is .9901.

(A.) Assume this hedge is designated as a cash flow hedge. Prepare the journal entries relating to the transaction and the forward contract.

(B.) Compute the effect on 2013 net income.

(C.) Compute the effect on 2014 net income.

Definitions:

Cash Flow Streams

Multiple flows of cash, either inflowing or outflowing from different sources or activities, over a period.

Firm Value

The monetary value assigned to a business entity, influenced by its operational performance, future earnings, and market conditions; essentially a measure of its worth in the marketplace.

Pre-Tax Salvage Value

The estimated resale value of an asset before taxes are considered, at the end of its useful life.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual amounts, reflecting a constant rate of expense over time.

Q2: Parsons Company acquired 90% of Roxy Company

Q7: Why is push-down accounting a popular internal

Q35: Parker Corp., a U.S. company, had the

Q43: The City of Nextville operates a motor

Q49: Which of the following is not a

Q73: What is the partial equity method?<br> How

Q74: Pigskin Co., a U.S. corporation, sold inventory

Q79: Walsh Company sells inventory to its subsidiary,

Q86: Royce Co. acquired 60% of Park Co.

Q88: The following information has been taken from