On January 1, 2015, John Doe Enterprises (JDE) acquired a 55% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share). At the time of the acquisition, BMI's book value was $16,970,000.

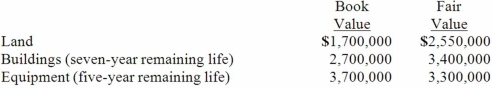

On January 1, JDE stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. BMI had the following balances on January 1, 2015.  For internal reporting purposes, JDE employed the equity method to account for this investment.

For internal reporting purposes, JDE employed the equity method to account for this investment.

The following account balances are for the year ending December 31, 2015 for both companies.

Definitions:

Perfectly Inelastic

Describing a situation where the quantity demanded or supplied of a good does not change in response to a price change.

Demand Curve

A graphical representation of the quantity of a good that consumers are willing and able to purchase at various prices during a given period.

Cross-Price Elasticity of Demand

A measure indicating how the quantity demanded of one good or service changes in response to a price change of another good or service.

Cross-Price Elasticity of Demand

The sensitivity measure of one good's demanded quantity to the price changes of a separate good.

Q16: A recent design process innovation,such as Dell's

Q24: According to the text,this activity represents an

Q31: When is the gain on an intra-entity

Q31: The following are preliminary financial statements for

Q39: When the fair value option is elected

Q56: Stevens Company has had bonds payable of

Q100: Pell Company acquires 80% of Demers

Q102: Strickland Company sells inventory to its parent,

Q115: The financial statements for Goodwin, Inc.

Q143: According to the text,increased emphasis on the