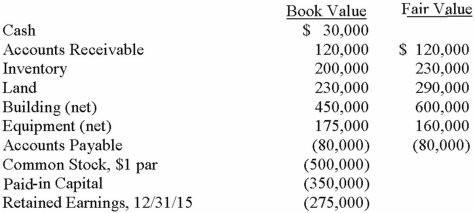

On January 1, 2013, Chester Inc. acquired 100% of Festus Corp.'s outstanding common stock by exchanging 37,500 shares of Chester's $2 par value common voting stock. On January 1, 2013, Chester's voting common stock had a fair value of $40 per share. Festus' voting common shares were selling for $6.50 per share. Festus' balances on the acquisition date, just prior to acquisition are listed below.  Required:

Required:

Compute the value of the Goodwill account on the date of acquisition, 1/1/15.

Definitions:

Recommendation

A suggestion or advice given based on analysis or expertise, aimed at guiding decisions or actions.

Routine Message

Everyday or regularly occurring communication that conveys standard information in business or personal contexts.

Routine Business Requests

Ordinary or regular solicitations or inquiries made in the course of business operations, often involving standard transactions or information gathering.

Direct Approach

A communication strategy that involves straightforwardly presenting information or a request without circumlocution.

Q24: According to the text,this activity represents an

Q27: Perry Company acquires 100% of the

Q34: When is a goodwill impairment loss recognized?<br>A)Annually

Q57: Royce Co. acquired 60% of Park

Q61: On January 4, 2013, Mason Co. purchased

Q65: On January 1, 2013, the Moody

Q76: Acker Inc. bought 40% of Howell

Q82: When comparing the difference between an upstream

Q93: On a consignment sale,the payment risk is<br>A)

Q113: Wilson owned equipment with an estimated