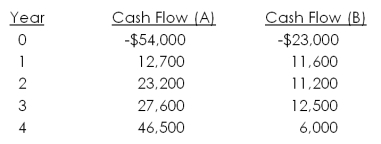

Consider the following two mutually exclusive projects:  Whichever project you choose, if any, you require a 14 percent return on your investment. If you apply the payback criterion, you will choose investment _____, if you apply the NPV criterion, you will choose investment _____; if you apply the IRR criterion, you will choose investment ____; if you choose the profitability index criterion, you will choose investment ____. Based on your first four answers, which project will you finally choose?

Whichever project you choose, if any, you require a 14 percent return on your investment. If you apply the payback criterion, you will choose investment _____, if you apply the NPV criterion, you will choose investment _____; if you apply the IRR criterion, you will choose investment ____; if you choose the profitability index criterion, you will choose investment ____. Based on your first four answers, which project will you finally choose?

Definitions:

Noncontrolling Interest

A shareholder's equity in a corporation that doesn't give the shareholder a controlling interest, representing a share of equity and earnings not owned by the parent company.

Net Income

The total earnings or profit of a company after subtracting all expenses, including taxes, from its revenues.

Domestic Corporations

Companies that are incorporated and operate within the legal boundaries of a country.

Excess Fair Value

The amount by which the fair value of an asset exceeds its carrying value on the balance sheet, often recognized during business combinations.

Q10: You expect to receive $12,000 at graduation

Q16: Aztec Movers pays a constant annual dividend

Q16: Today, you deposit $2,400 in a bank

Q26: Phil's Dinor purchased some new equipment 2

Q62: Which one of the following is the

Q70: Waterfront Shirts is a specialty retailer offering

Q73: Kristi is considering an investment that will

Q76: A stock has had returns of 11

Q98: Rock Haven has a proposed project that

Q112: An unexpected decrease in market interest rates