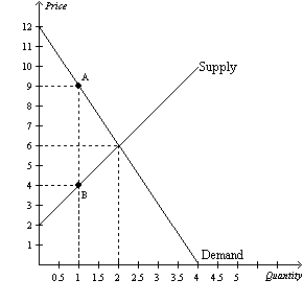

Figure 8-2

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-2.The amount of the tax on each unit of the good is

Definitions:

Unit-level Activities

Activities in cost accounting that vary with the number of units produced, such as operating machinery for each unit.

Departmental Unit

A division within an organization with specific responsibilities, often based on function, product line, or geographical area.

Overhead Costs

Expenses related to the operation of a business that are not directly associated with the production of goods or services, such as rent and utilities.

Batch Set-ups

The process of preparing and adjusting equipment and processes for a specific batch of production.

Q8: Who once said that taxes are the

Q62: Each seller of a product is willing

Q65: A $3.50 tax per gallon of paint

Q92: Refer to Figure 8-7.Which of the following

Q115: Refer to Figure 9-6.The amount of revenue

Q146: If the United States changed its laws

Q217: Economists generally agree that the most important

Q343: Refer to Table 7-7.Who is a marginal

Q356: In a competitive market,sales go to those

Q398: Refer to Figure 9-11.Producer surplus in this