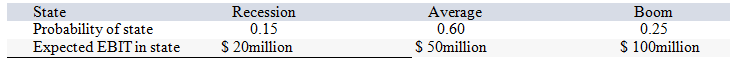

Your company doesn't face any taxes and has $800 million in assets, currently financed entirely with equity. Equity is worth $60 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 20 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

Definitions:

Equitable Pay Structure

A compensation system designed to fairly reward employees based on job roles, experience, performance, and market rates, ensuring fairness and equality.

Wage Costs

The total expenditure incurred by an employer for the payment of wages to employees, including salaries, bonuses, and overtime pay.

Employee Performance

Employee performance refers to how well an employee fulfills their job duties and executes their tasks, often measured against pre-defined benchmarks or objectives.

Statistical/Policy Capturing

A method used to analyze the decision-making process by capturing the rules and models people use to make decisions.

Q11: Your company doesn't face any taxes and

Q28: A financial analyst calculated that the after-tax

Q41: Your company faces a 34 percent tax

Q43: JEN Corp. is expected to pay a

Q45: Calculate the total fees a firm would

Q74: Convert the following indirect quote to a

Q84: An exchange rate regime where the country's

Q84: Suppose that Lil John Industries' equity is

Q85: Which of the following is the technique

Q89: Due to rapid growth, a computer superstore