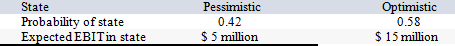

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the standard deviation in EPS if they switch to the proposed capital structure?

Definitions:

Average Costs

The cost per unit is determined by dividing the total production cost by the number of units manufactured.

Long Run

A period sufficient for all inputs to production, including physical capital, to be adjusted.

Shut-Down

A temporary or permanent cessation of operations in a business or factory, often due to financial difficulties or external factors.

Marginal Costs

The additional cost incurred from producing one more unit of a product or service.

Q11: Your company doesn't face any taxes and

Q15: Your company faces a 34 percent tax

Q17: A U.S. firm is expecting cash flows

Q38: Which statement makes this a false statement?

Q45: Compute the IRR for Project X

Q48: Suppose your firm is considering two

Q49: If the price of silver in England

Q60: Building Supplies is considering a merger with

Q64: The additional funds needed by the firm

Q106: Which of these statements is true regarding