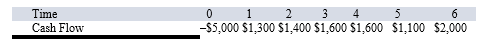

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. Use the payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Market Risk Premium

The extra return investors demand for choosing to invest in the market over a risk-free asset.

Capital Structure Weights

The proportions of a firm's financing that come from different types of capital, such as equity, debt, and preferred stock, used to calculate the weighted average cost of capital (WACC).

Market Value

The now rate for transactions involving the purchase or sale of assets or services.

Debt

Money borrowed by one party from another, under the condition it will be paid back often with interest, used by individuals, businesses, and governments to finance activities.

Q11: If you invested $1,000 in Disney and

Q11: Which of the following is used to

Q19: You are evaluating a project for The

Q36: Suppose a firm has had the historical

Q51: A situation that arises when a firm's

Q62: KADS, Inc., has spent $400,000 on research

Q63: The optimal cash replenishment level will decrease

Q68: Which of these is used as a

Q69: Why is debt often referred to as

Q92: Which of these is the measurement of