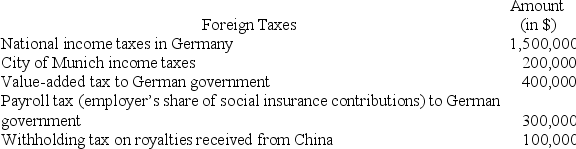

Rainier Corporation,a U.S.corporation,manufactures and sells quidgets in the United States and Europe.Rainier conducts its operations in Europe through a German GmbH,which the company elects to treat as a branch for U.S.tax purposes.Rainier also licenses the rights to manufacture quidgets to an unrelated company in China.During the current year,Rainier paid the following foreign taxes,translated into U.S.dollars at the appropriate exchange rate:

What amount of creditable foreign taxes does Rainier incur?

What amount of creditable foreign taxes does Rainier incur?

Definitions:

Emotional Occurrence

An event that triggers a significant emotional reaction, emphasizing the impact on personal feeling states.

Thalamus

A critical structure within the brain that acts as a relay center, processing and transmitting sensory and motor signals to the cerebral cortex.

Cerebral Cortex

The cerebral cortex is the outer layer of the brain's cerebrum, playing a key role in memory, attention, perception, cognition, awareness, thought, language, and consciousness.

Autonomic Nervous System

The part of the peripheral nervous system that controls involuntary body functions like heartbeat and digestion.

Q10: XYZ Corporation (an S corporation)is owned by

Q23: In what order should the tests to

Q31: Aiden transferred $2 million to an irrevocable

Q79: When an S corporation distributes appreciated property

Q91: At her death,Tricia owned a life insurance

Q104: The payroll factor includes payments to independent

Q113: The Mobil decision identified three factors to

Q123: The built-in gains tax does not apply

Q191: The accounts of Odie Company with

Q194: In a business decision where there are