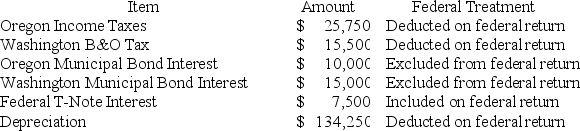

Moss Incorporated is a Washington corporation.It properly included,deducted,or excluded the following items on its federal tax return in the current year:

Moss' Oregon depreciation was $145,500.Moss' Federal Taxable Income was $549,743.Calculate Moss' Oregon state tax base.

Moss' Oregon depreciation was $145,500.Moss' Federal Taxable Income was $549,743.Calculate Moss' Oregon state tax base.

Definitions:

Output Contract

An agreement between a producer and a buyer to sell and purchase a specific amount of output at a specified price.

Specialization

The process of focusing efforts on a specific activity, product, or service to gain efficiency or quality improvements.

Economically Beneficial

Describes actions, policies, or activities that result in a positive impact on economic well-being, efficiency, or growth.

Fixed Amounts

Quantities that remain constant and do not change over time, regardless of any external conditions or variables.

Q7: A rectangle with an inverted triangle within

Q24: Cedar Corporation incurs a net capital loss

Q34: On March 15,20X9,Troy,Peter,and Sarah formed Picture Perfect

Q43: James and Jasmine live in a community

Q75: Under most U.S.treaties,a resident of the other

Q99: The "family attribution" rules are automatically waived

Q104: At his death,Trevor had a probate estate

Q107: CB Corporation was formed as a calendar-year

Q113: The Mobil decision identified three factors to

Q168: What distinguishes liabilities from equity?