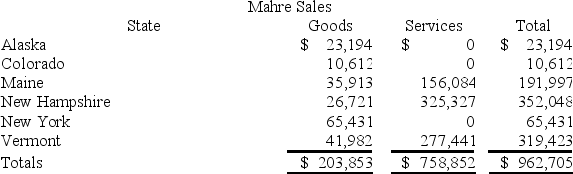

Mahre,Incorporated,a New York corporation,runs ski tours in a several states.Mahre also has a New York retail store and an Internet store which ships to out of state customers.The ski tours operate in Maine,New Hampshire,and Vermont where Mahre has employees and owns and uses tangible personal property.Mahre has real property only in New York.Mahre has the following sales:  Assume the following sales tax rates: Alaska (6.6 percent) ,Colorado (7.75 percent) ,Maine (8.5 percent) ,New Hampshire (0 percent) ,New York (8 percent) ,and Vermont (5 percent) .How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (6.6 percent) ,Colorado (7.75 percent) ,Maine (8.5 percent) ,New Hampshire (0 percent) ,New York (8 percent) ,and Vermont (5 percent) .How much sales and use tax must Mahre collect and remit?

Definitions:

Crop Plants

Plants grown in significant quantities to be harvested as food, feed, fiber, fuel, or other uses, including vegetables, grains, and fruits.

Gene

A unit of heredity found in living organisms that encodes the instructions for synthesizing proteins, influencing traits and functions.

Biological Molecules

Organic compounds essential to life, including carbohydrates, lipids, proteins, and nucleic acids, forming the structure and performing the functions of living organisms.

Fatty Acids

Long-chain hydrocarbons that contain a carboxylic acid group at one end. They are an important component of lipids in living organisms.

Q24: Alpha Company has assets of $600,000, liabilities

Q33: Tim,a real estate investor,Ken,a dealer in securities,and

Q61: Which of the following is an income

Q70: J&J,LLC was in its third year of

Q74: Clampett,Inc.(an S corporation)previously operated as a C

Q79: The stockholders' claim on assets, also known

Q82: Which of the following requirements do not

Q87: Which of the following statements regarding the

Q98: The characteristics below apply to at

Q154: In accounting, the rule that requires that