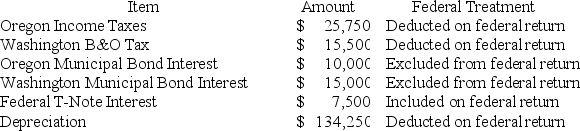

Moss Incorporated is a Washington corporation.It properly included,deducted,or excluded the following items on its federal tax return in the current year:

Moss' Oregon depreciation was $145,500.Moss' Federal Taxable Income was $549,743.Calculate Moss' Oregon state tax base.

Moss' Oregon depreciation was $145,500.Moss' Federal Taxable Income was $549,743.Calculate Moss' Oregon state tax base.

Definitions:

Untruths

Untruths are statements or assertions that are not in alignment with reality or facts, often synonymous with falsehoods or lies.

Exaggerations

Statements that stretch the truth or describe something as greater or more extreme than it actually is.

Spokesbloggers

Influential bloggers who are engaged to represent and promote a brand, product, or service, often to leverage their follower base for marketing purposes.

Paid Contributions

Financially compensated efforts or content provided by individuals or entities, often found in creative, academic, or digital platforms.

Q4: Simone transferred 100 percent of her stock

Q26: Control as it relates to a section

Q35: Greenwich Corporation reported a net operating loss

Q50: Which of the following would not be

Q68: Actual or deemed cash distributions in excess

Q69: Purchases of inventory for resale are typically

Q72: What is the purpose of return on

Q89: Gwendolyn was physically present in the United

Q92: Suppose Clampett,Inc.terminated its S election on August

Q120: The theft of property included in the