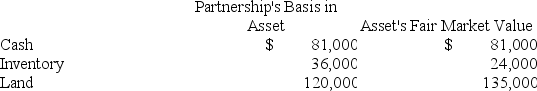

Doris owns a 1/3 capital and profits interest in the calendar-year DB Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $20,000.On that date,she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Systemic Justice

The concept of achieving fairness and equality within the systems and structures of society, addressing systemic biases and inequalities.

Communal-sharing Relationship

A type of relationship where members of a group share resources and responsibilities equally, without regards to individual input.

Future Interaction

The anticipated exchange or engagement between parties in the time ahead.

Party's Outcomes

The results or consequences experienced by an individual or group following a decision, action, or negotiation.

Q11: Guido was physically present in the United

Q17: Why are guaranteed payments deducted in calculating

Q30: An S election is terminated if the

Q50: Robinson Company had a net deferred tax

Q74: WFO Corporation has gross receipts according to

Q76: Mighty Manny,Incorporated manufactures ice scrapers and distributes

Q82: Farm Corporation reported pretax book loss of

Q84: Gordon operates the Tennis Pro Shop in

Q88: The tax effects of permanent differences are

Q94: What is the difference between a partner's