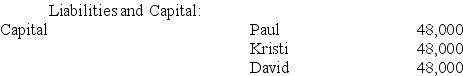

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000.Just prior to the sale,Paul's outside and inside bases in KDP are $48,000.KDP's balance sheet includes the following:

If KDP has a §754 election in place,what is Kathy's special basis adjustment?

If KDP has a §754 election in place,what is Kathy's special basis adjustment?

Definitions:

Q1: Moss Incorporated is a Washington corporation.It properly

Q10: Purple Rose Corporation reported pretax book income

Q16: The Canadian government imposes a withholding tax

Q25: Martha is a 40% partner in the

Q44: Which of the following statements is true

Q62: Sunapee Corporation reported taxable income of $700,000

Q73: Orono Corporation manufactured inventory in the United

Q76: DeWitt Corporation reported pretax book income of

Q80: Phillip incorporated his sole proprietorship by transferring

Q105: Which of the following items are subject