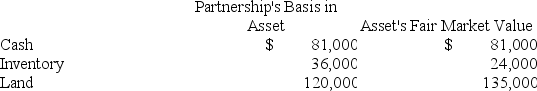

Doris owns a 1/3 capital and profits interest in the calendar-year DB Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $20,000.On that date,she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Slave Labor

The coerced labor of enslaved individuals, without pay or personal freedom, used historically in various societies and economies worldwide.

Upper South

A region in the United States characterized by states that were historically part of the Confederacy but had mixed loyalties during the Civil War.

Lower South

Refers to the southernmost states of the U.S., including Alabama, Florida, Georgia, Louisiana, Mississippi, South Carolina, and Texas, known for their deep historical association with slavery and the Confederacy.

Presidential Election

A national election held in a country that determines who will hold the office of the president.

Q3: A section 338 transaction is a stock

Q14: A shareholder will own the same percentage

Q17: Evergreen Corporation distributes land with a fair

Q20: Assume that at the end of 2017,Clampett,Inc.(an

Q40: Gordon operates the Tennis Pro Shop in

Q56: Which of the following items are subject

Q95: A corporation's effective tax rate as computed

Q102: Carolina's Hats has the following sales,payroll and

Q106: At his death,Titus had a gross estate

Q110: Mighty Manny,Incorporated manufactures and services deli machinery