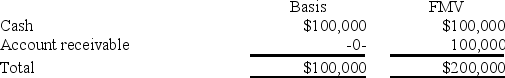

Nadine Fimple is a one-half partner in the NL Partnership with equal inside and outside bases.On January 1,NL distributes accounts receivable with a fair value of $100,000 to Nadine as an operating distribution.NL's balance sheet as of January 1 is as follows:

What is the amount and character of Nadine's recognized gain or loss on the distribution?

What is the amount and character of Nadine's recognized gain or loss on the distribution?

Definitions:

Employee Turnover

The rate at which employees leave a company and are replaced by new employees over a particular period.

Compensation Expense

Costs incurred by an employer to pay employees, including wages, benefits, and bonuses.

Stock Appreciation Rights

A type of employee incentive that grants the right to receive a bonus equal to the appreciation in the company's stock over a set period.

Compensation Expense

An accounting expense recognized in the books, representing the cost of the benefits provided to employees, including wages, salaries, and bonuses.

Q23: In what order should the tests to

Q28: General Inertia Corporation made a distribution of

Q33: For the holidays,Samuel gave a necklace worth

Q37: Failure to collect and remit sales taxes

Q52: Built-in gains recognized fifteen years after a

Q65: Suppose at the beginning of 2017,Jamaal's basis

Q65: Mandel transferred property to his new corporation

Q75: BPA Partnership is an equal partnership in

Q89: Gwendolyn was physically present in the United

Q98: XYZ was formed as a calendar-year S