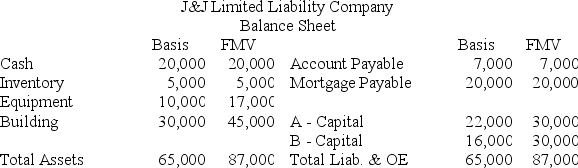

J&J,LLC was in its third year of operations when J&J decided to expand the number of members from two,A & B,with equal profits and capital interests to three members,A,B,and C.The third member,C,will contribute her financial expertise to the LLC in exchange for a 1/3 capital interest in J&J.Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted,what are the tax consequences to members A,B,and C,and to J&J when C receives her capital interest? If,instead,member C receives a 1/3 profit interest,what would be the tax consequences to members A,B,and C,and to J&J?

Definitions:

Aging

The process of becoming older, which involves a gradual decline in physiological function and increased susceptibility to diseases.

College-educated Women

Women who have completed a college degree or higher education.

Adaptive Expectations

A theory assuming people form their expectations about the future based on past experiences and adjust them as new information becomes available.

Rational Expectations

A theory suggesting that individuals form future expectations based on all available information, including predictions about monetary and fiscal policies.

Q39: Which of the following statements best describes

Q41: Battle Corporation redeems 20 percent of its

Q46: Styling Shoes,LLC filed its 20X8 Form 1065

Q54: Publicly-traded companies usually file their financial statements

Q69: Inventory is substantially appreciated if the fair

Q69: What form is used by a U.S.corporation

Q80: Corporations have a larger standard deduction than

Q97: Han transferred land to his corporation in

Q98: Spartan Corporation,a U.S.company,manufactures widgets for sale in

Q107: Mahre,Incorporated,a New York corporation,runs ski tours in