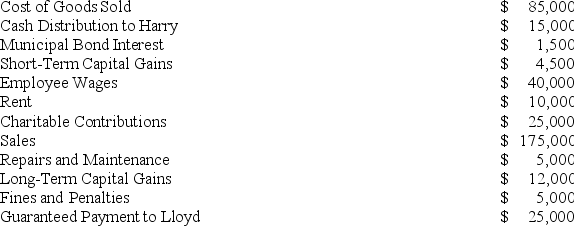

Lloyd and Harry,equal partners,form the Ant World Partnership.During the year,Ant World had the following revenue,expenses,gains,losses,and distributions:

Given these items,what amount of ordinary business income (loss)and what separately-stated items should be allocated to each partner for the year?

Given these items,what amount of ordinary business income (loss)and what separately-stated items should be allocated to each partner for the year?

Definitions:

Behavioral Differences

Variations in actions and reactions among individuals or groups, often influenced by biological, psychological, and social factors.

Ethnic Groups

Communities or populations sharing a common culture, ancestry, language, or national origin.

Ethnic Groups

Ethnic Groups are categories of people who identify with each other based on common language, ancestry, culture, history, or society.

Hispanic Americans

Americans who are descendants of people from Spanish-speaking countries in Latin America and Spain, with distinct cultural, historical, and social backgrounds.

Q11: Which of the following is not an

Q20: An unincorporated entity with more than one

Q36: To make an S election effective as

Q38: Lola is a 35% partner in the

Q59: In 2014,Smith Traders Inc.reported taxable income of

Q66: The adjusted current earnings (ACE)adjustment is 75%

Q75: Z Corporation has AMTI of $250,000,which exceeds

Q99: Net operating losses generally create permanent book-tax

Q117: Assume that at the end of 2017,Clampett,Inc.(an

Q130: For tax purposes,companies using nonqualified stock options