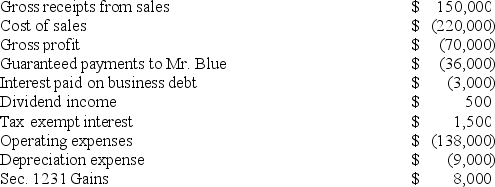

On January 1,20X9,Mr.Blue and Mr.Grey each contributed $100,000 to form the B&G general partnership.Their partnership agreement states that they will each receive a 50% profits and loss interest.The partnership agreement also provides that Mr.Blue will receive an annual $36,000 guaranteed payment.B&G began business on January 1,20X9.For its first taxable year,its accounting records contained the following information.

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30,20X9.B&G repaid $10,000 of the loan on December 15,20X9.Neither of the partners received a cash distribution from B&G in 20X9.

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30,20X9.B&G repaid $10,000 of the loan on December 15,20X9.Neither of the partners received a cash distribution from B&G in 20X9.

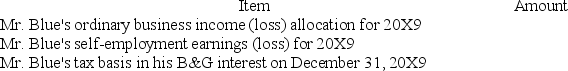

Complete the following table related to Mr.Blue's interest in B&G partnership:

Definitions:

Navigation Pane

A sidebar on a user interface that allows users to quickly access different sections or functionalities of an application or website.

Rename A Form

Changing the name of a form within software applications, often to better reflect its purpose or contents.

Form View

A user interface design or mode that displays a form to input or display data, commonly found in databases and applications.

Print Preview

A feature in many computer programs that allows users to see exactly how a document will look when printed, before actually printing it.

Q1: Which of the following is a requirement

Q25: Roberta transfers property with a tax basis

Q41: If a corporation's cash charitable contributions exceed

Q48: Joan is a 1/3 partner in the

Q48: Which of the following statements is true?<br>A)

Q58: A cumulative financial accounting (book)loss over three

Q66: Continuity of interest as it relates to

Q66: Whitman Corporation reported pretax book income of

Q67: Which of the following items will affect

Q121: During 2017,CDE Corporation (an S corporation since