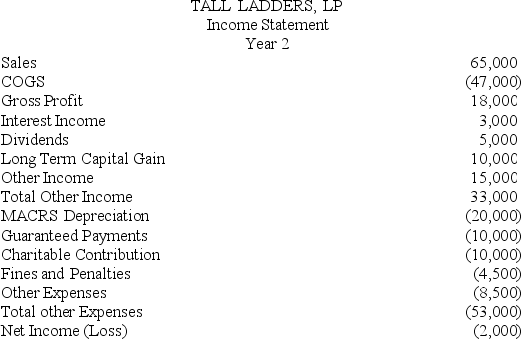

At the end of year 1,Tony had a tax basis of $40,000 in Tall Ladders,Limited Partnership.Tony has a 20 percent profits interest in Tall Ladders.For year 2,Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership.Given the following Income Statement and Balance Sheet from Tall Ladders,what is Tony's adjusted tax basis at the end of year 2?

Definitions:

Halogens

A group of highly reactive elements located in Group 17 of the periodic table, which include fluorine, chlorine, bromine, iodine, and astatine.

Atomic Symbol

A one- or two-letter notation used to represent an element, based on its Latin name.

Copper

A red-orange metallic element that is ductile and conductive, used extensively in electrical wiring and plumbing.

Atomic Symbol

A one or two-letter notation representing a chemical element (e.g., H for hydrogen, O for oxygen) based on its name, often derived from Latin.

Q5: Viking Corporation is owned equally by Sven

Q6: Carmello is a one-third partner in the

Q10: The dividends received deduction is designed to

Q10: Purple Rose Corporation reported pretax book income

Q27: A calendar-year corporation has positive current E&P

Q39: Windmill Corporation,a Dutch corporation,is owned by the

Q72: Like partnerships,S corporations generally determine their accounting

Q83: In December 2017,Zeb incurred a $100,000 loss

Q100: The recipient of a taxable stock dividend

Q110: Mighty Manny,Incorporated manufactures and services deli machinery