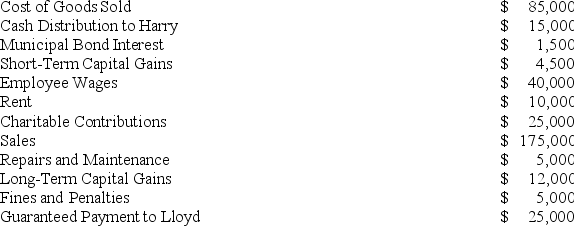

Lloyd and Harry,equal partners,form the Ant World Partnership.During the year,Ant World had the following revenue,expenses,gains,losses,and distributions:

Given these items,what amount of ordinary business income (loss)and what separately-stated items should be allocated to each partner for the year?

Given these items,what amount of ordinary business income (loss)and what separately-stated items should be allocated to each partner for the year?

Definitions:

Obesity

A health disorder defined by an excessive accumulation of body fat, leading to an elevated risk of medical complications.

Portion Size

The amount of a particular food that is served to one person, typically in a single eating occasion.

Neophobia

The fear or aversion to new experiences, ideas, or unfamiliar situations.

Body Mass Index

A numerical measurement of a person's weight in relation to their height, used to classify underweight, healthy weight, overweight, and obesity.

Q15: The SSC Partnership balance sheet includes the

Q23: In what order should the tests to

Q28: Orange Inc.issued 20,000 nonqualified stock options valued

Q29: The state tax base is computed by

Q29: Randolph is a 30% partner in the

Q36: Unreasonable compensation issues are more likely to

Q39: Which of the following is not an

Q58: A single-member LLC is taxed as a

Q66: If Annie and Andy (each a 30%

Q76: DeWitt Corporation reported pretax book income of