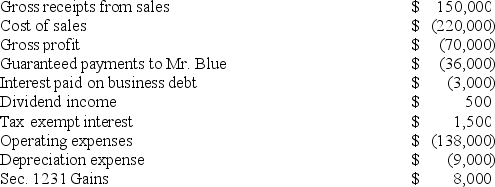

On January 1,20X9,Mr.Blue and Mr.Grey each contributed $100,000 to form the B&G general partnership.Their partnership agreement states that they will each receive a 50% profits and loss interest.The partnership agreement also provides that Mr.Blue will receive an annual $36,000 guaranteed payment.B&G began business on January 1,20X9.For its first taxable year,its accounting records contained the following information.

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30,20X9.B&G repaid $10,000 of the loan on December 15,20X9.Neither of the partners received a cash distribution from B&G in 20X9.

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30,20X9.B&G repaid $10,000 of the loan on December 15,20X9.Neither of the partners received a cash distribution from B&G in 20X9.

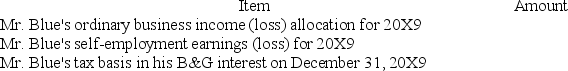

Complete the following table related to Mr.Blue's interest in B&G partnership:

Definitions:

Union Members

Individuals who belong to a labor union, which is an organization that represents workers' interests in negotiations with employers.

Workers

Individuals engaged in a particular activity or employment, either for wages or as part of a specified task.

Demotion

The action of reducing someone's rank, status, or position, often as a disciplinary measure or organizational restructuring.

Freedom of Speech

The right to express one's opinions and ideas without fear of government retaliation or censorship.

Q17: A company's effective tax rate can best

Q23: Gordon operates the Tennis Pro Shop in

Q28: Orange Inc.issued 20,000 nonqualified stock options valued

Q35: Partnerships can use special allocations to shift

Q39: Sparrow Corporation reported pretax book income of

Q42: Joan is a 30% partner in the

Q46: Styling Shoes,LLC filed its 20X8 Form 1065

Q56: Which of the following items are subject

Q62: Depreciation adjustments can increase or decrease the

Q67: Which of the following items will affect